In this video you will be guided on how to generate th. All partnerships and sole proprietorships must now file this form as well.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

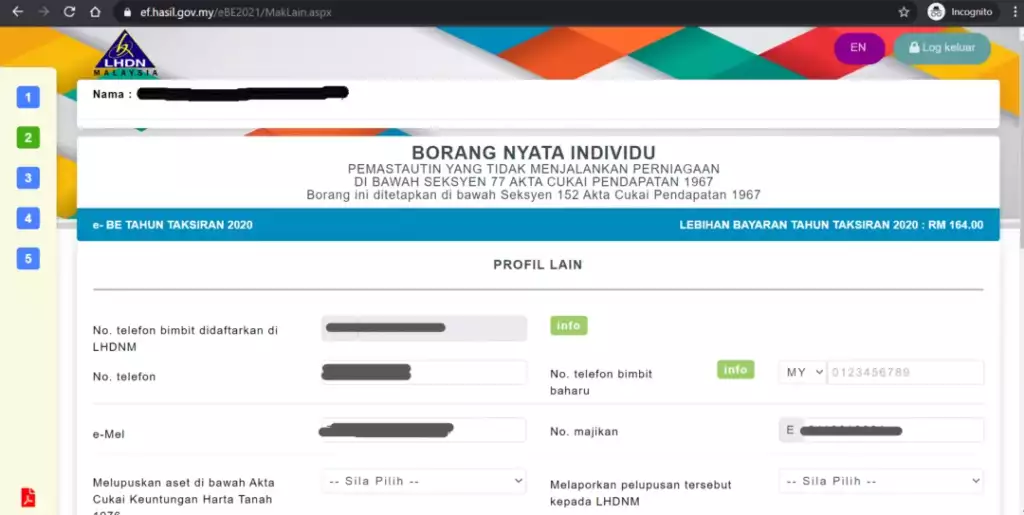

Submission of borang b 2018 2.

. 7 The use of e-Filing e-BE is encouraged. Gunakan satu 1 CD pemacu USB cakera keras luaran untuk satu 1 nombor E. If a company fails to produce their Borang E before the given time they posses a risk of being fined for RM.

According to the Income Tax Act 1967 Akta 53. Pengemukaan CP8D melalui disket TIDAK dibenarkan. IJJSS2019-Corect2019 Submit Abstract Deadline Submission The new deadline for submission of abstracts is now the 16th September 2019.

Received a letter from Lhdn majikan department saying year 2016 got penalty for Borang E for late submission and letter suggest me to contact Guaman Lhdn to settle so. 31 Mac 2019 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2019. Talenox is a self-service HR SaaS that helps thousands of companies avoid penalisations and audits by accurately auto-calculating their salaries and taxes for free.

July 5 2022 Deadline Full Paper Submission. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. May 15 for electronic filing ie.

Present July 4 2022 Notification of Abstract. 1 Tarikh akhir pengemukaan borang. Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D.

To skip between groups use CtrlLEFT or CtrlRIGHT. The following information are required to fill up the Borang E. Majikan yang telah menghantar maklumat melalui e-Data Praisi tidak perlu mengisi dan menghantar CP8D.

8 For further information please contact Hasil Care Line- -800 88 5436 LHDN Calls from overseas. All companies must file Borang E regardless of whether they have employees or not. 603 77136666 BE 2018 YEAR OF ASSESSMENT FormLEMBAGA HASIL DALAM NEGERI MALAYSIA CP4B Pin.

Million Payroll System - Step-by-Step GuidanceMeet problem while performing E-submission for Borang E. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran. To jump to the first Ribbon tab use Ctrl.

Every employer shall for each year furnish to the Director General a return in the prescribed form. Any dormant or non-performing company must also file LHDN E-Filing. Aug 2018 Hello everyone anyone Im in the midst of closing my Sdn Bhd.

One Borang E-ready software you can consider from the list is Talenox. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. April 30 for manual submission.

2018 i Submission of a Complete and Acceptable Form E a Form E shall only be considered complete if CP8D is furnished on or before the due date for submission of the form. To navigate through the Ribbon use standard browser navigation keys. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March.

Klik pada pautan e-Borang di bawah menu e-Filing. The new changes will come into effect on 1 September 2018 and involves only ATIGA Scheme as to accommodate e-form D ATIGA. The following information are required to fill up the Borang E.

With Talenox Payroll you can submit Borang E in just 3 steps. The Borang E must be submitted by the 31st of march of every year. The earnings that are to be included in CP8D form should be shown in Borang E.

Borang E contains information like the company particulars and details of every employees earnings in the company. Majikan digalakkan mengemukakan CP8D secara e-Filing sekiranya Borang E dikemukakan melalui e-Filing. Borang E is an Employers annual Return of Remuneration for every calendar year and due for submission by 31st March of the following calendar year.

B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2019 adalah menjadi satu kesalahan di bawah. Corporation Income Tax Filing Scarborough Filing Taxes Tax Consulting Income Tax After your Borang 1 2 have been efiled and the status has changed to Diluluskan you can immediately proceed to file your Borang 3 4 5 within the next few days. 1 Due date to furnish this form31 March 2019.

Please access via httpsezhasilgovmy. 2018 RETURN FORM OF A INDIVIDUAL. All Income Tax Return Forms must be submitted within 30 days from the date stated on the form or for period that has been set by the government.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News Cheam Associates 2 Max Co Chartered Accountants Posts Facebook What Is Cp22. Details for ALL employees remuneration matters to be included in the CP8D. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March.

Head over to Payroll Payroll Settings Form E. Contribute to listianiana8diraya development by creating an account on GitHub. Details for ALL employees remuneration matters to be included in the CP8D.

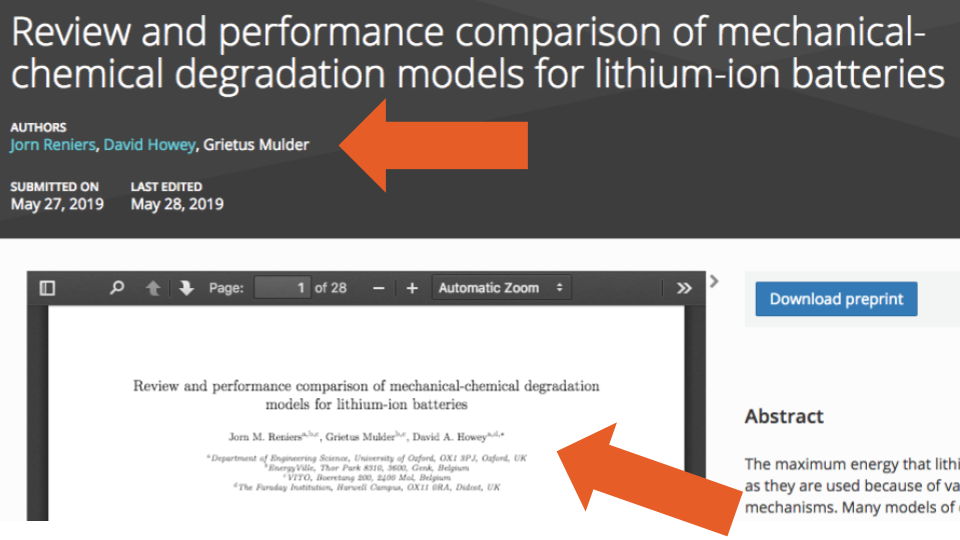

Scholcommlab Scholarly Communications Lab Scholcommlab

Malaysia Tax Guide What Is And How To Submit Borang E Form E The Vox Of Talenox

Malaysia Tax Guide What Is And How To Submit Borang E Form E The Vox Of Talenox

Kc Tax Services Posts Facebook

Kt Ng Associates Chartered Accountants Home Facebook

Google Forms Skip Questions Based On Answers Youtube

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Payroll Borang E Form 2 Otosection

Form E 2018 What You Need To Know Kk Ho Co

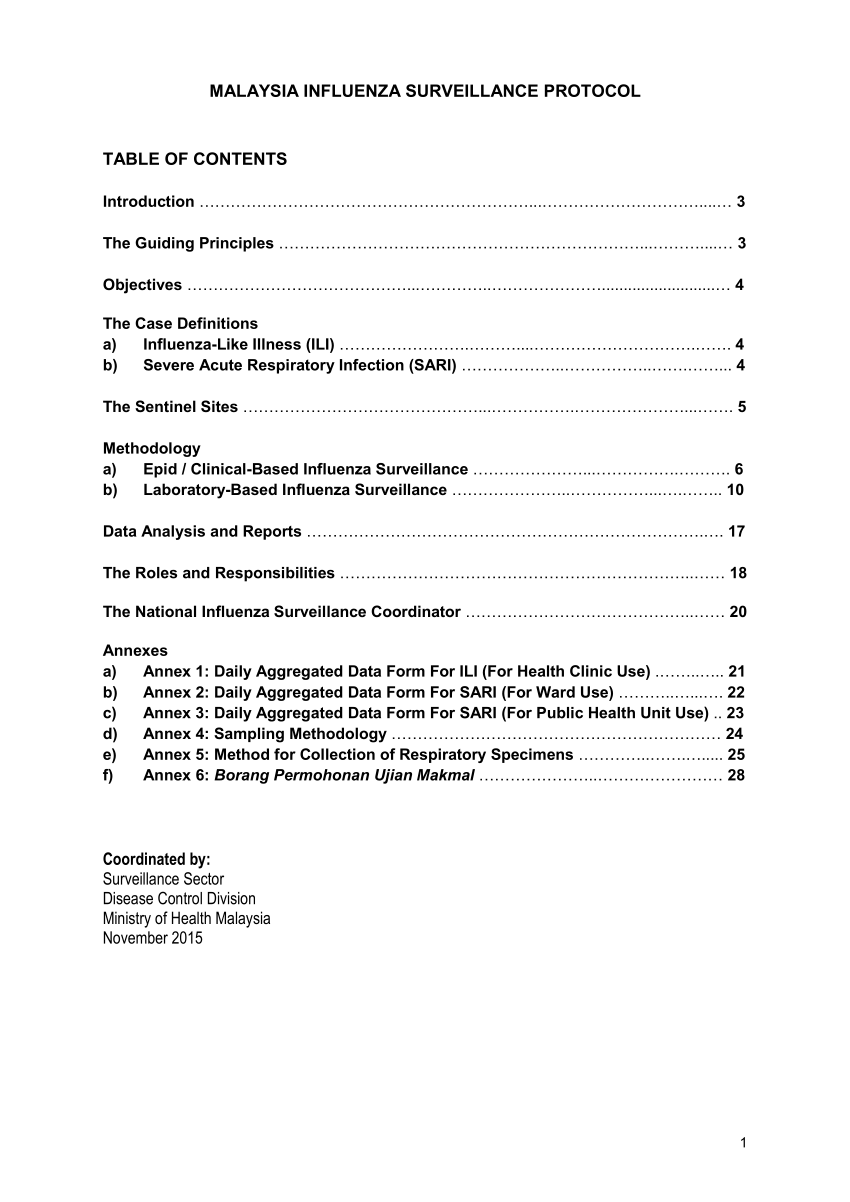

Pdf Malaysia Influenza Surveillance Protocol

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Payroll Borang E Form 2 Otosection

How To File Your Income Tax In Malaysia 2022 Ver

Corporation Income Tax Filing Scarborough Filing Taxes Tax Consulting Income Tax

Malaysia Tax Guide What Is And How To Submit Borang E Form E The Vox Of Talenox

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Payroll Borang E Form 2 Otosection